What Does Custom Private Equity Asset Managers Mean?

Wiki Article

Things about Custom Private Equity Asset Managers

(PE): investing in business that are not publicly traded. Approximately $11 (https://businesslistingplus.com/profile/cpequityamtx/). There might be a couple of points you do not understand about the market.

Exclusive equity companies have a variety of financial investment preferences.

Due to the fact that the best gravitate towards the larger deals, the center market is a significantly underserved market. There are extra vendors than there are very skilled and well-positioned money professionals with substantial buyer networks and sources to manage an offer. The returns of personal equity are usually seen after a few years.

Excitement About Custom Private Equity Asset Managers

Flying below the radar of big international companies, most of these small firms commonly give higher-quality client service and/or specific niche product or services that are not being offered by the large conglomerates (http://go.bubbl.us/ddd0a6/87fd?/New-Mind-Map). Such benefits draw in the interest of exclusive equity firms, as they possess the understandings and smart to exploit such possibilities and take the business to the next degree

Private equity capitalists should have trusted, capable, and dependable monitoring in position. Most managers at portfolio business are given equity and perk compensation frameworks that compensate them for hitting their economic targets. Such placement of goals is usually called for before a deal gets done. Private equity possibilities are commonly out of reach for individuals that can't spend millions of bucks, but they shouldn't be.

There are regulations, such as limits on the accumulation quantity of cash and on the variety of non-accredited financiers. The private equity company attracts a few of the very best and brightest in company America, including top performers from Lot of money 500 business and elite monitoring consulting companies. Legislation companies can also be article source recruiting premises for personal equity works with, as bookkeeping and legal abilities are essential to complete deals, and deals are very searched for. https://www.youmagine.com/cpequityamtx/designs.

The 4-Minute Rule for Custom Private Equity Asset Managers

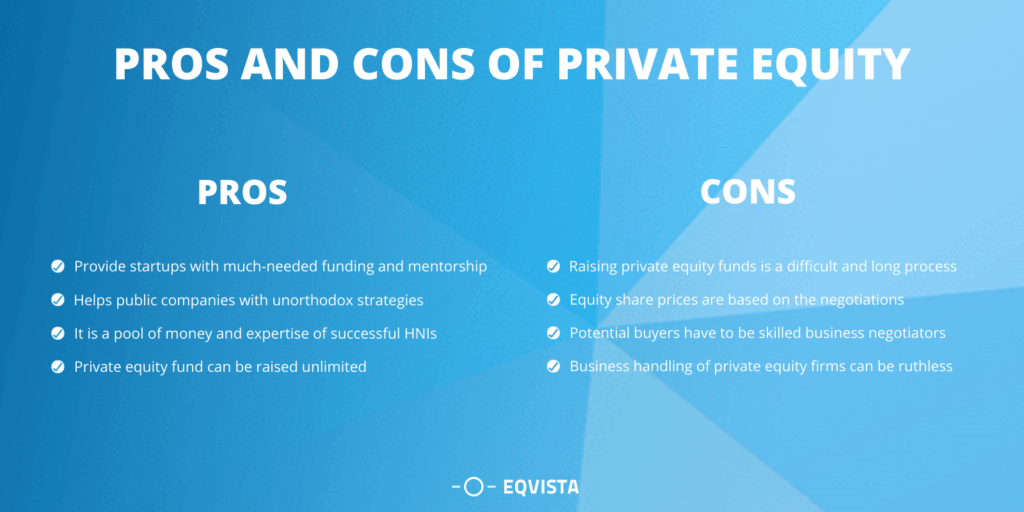

Another disadvantage is the absence of liquidity; once in a private equity deal, it is not easy to get out of or offer. There is an absence of flexibility. Personal equity likewise comes with high charges. With funds under management currently in the trillions, exclusive equity firms have actually come to be attractive investment cars for rich individuals and institutions.

Currently that accessibility to private equity is opening up to more individual investors, the untapped possibility is becoming a fact. We'll begin with the major arguments for investing in exclusive equity: How and why exclusive equity returns have traditionally been higher than other properties on a number of degrees, Just how including private equity in a profile influences the risk-return account, by aiding to diversify versus market and cyclical threat, Then, we will detail some essential factors to consider and dangers for personal equity capitalists.

When it pertains to presenting a brand-new asset right into a profile, one of the most standard consideration is the risk-return account of that asset. Historically, exclusive equity has displayed returns comparable to that of Emerging Market Equities and greater than all various other traditional property classes. Its relatively low volatility combined with its high returns creates a compelling risk-return account.

The Single Strategy To Use For Custom Private Equity Asset Managers

Exclusive equity fund quartiles have the best array of returns across all alternate possession classes - as you can see listed below. Methodology: Internal price of return (IRR) spreads out determined for funds within classic years separately and afterwards balanced out. Median IRR was calculated bytaking the average of the mean IRR for funds within each vintage year.

The takeaway is that fund option is crucial. At Moonfare, we execute a strict selection and due persistance procedure for all funds listed on the system. The result of including personal equity right into a profile is - as constantly - based on the profile itself. Nevertheless, a Pantheon research from 2015 recommended that consisting of exclusive equity in a portfolio of pure public equity can open 3.

On the various other hand, the most effective personal equity firms have access to an even larger pool of unidentified opportunities that do not deal with the same analysis, as well as the resources to carry out due persistance on them and recognize which deserve investing in (Syndicated Private Equity Opportunities). Investing at the first stage suggests higher threat, but also for the business that do succeed, the fund gain from greater returns

The smart Trick of Custom Private Equity Asset Managers That Nobody is Talking About

Both public and personal equity fund supervisors devote to spending a percentage of the fund but there stays a well-trodden concern with aligning rate of interests for public equity fund monitoring: the 'principal-agent problem'. When a financier (the 'primary') hires a public fund manager to take control of their capital (as an 'representative') they entrust control to the supervisor while maintaining ownership of the assets.

When it comes to personal equity, the General Companion doesn't simply earn an administration fee. They also make a percentage of the fund's earnings in the type of "lug" (usually 20%). This ensures that the rate of interests of the manager are aligned with those of the capitalists. Personal equity funds likewise minimize another kind of principal-agent issue.

A public equity capitalist ultimately desires one point - for the monitoring to raise the supply rate and/or pay returns. The capitalist has little to no control over the decision. We revealed over the number of private equity techniques - particularly majority acquistions - take control of the operating of the business, guaranteeing that the long-lasting worth of the company comes initially, rising the return on financial investment over the life of the fund.

Report this wiki page